Business S-Corp Formation

Get It Right from the Beginning

Forming a Corporation (S-Corp) in Pennsylvania?

At ESQx Business Law, we help entrepreneurs choose to file their businesses as an S-Corporation when they’re looking to save money on their taxes by passing through the company’s income, losses, deductions, and credits to its shareholders, who report them on their individual tax returns. The major benefit to S-Corps is the fact that, essentially, the owner of an S-Corp is taxed as an employee of the business by paying him- or herself a salary, instead of being taxed as an owner. In other words, if you select S-Corp designation, you will pay FICA and income taxes on your salary as if you were a salaried employee. There is no self-employment tax. More on that below.

We’ll assume you’ve already read our previous posts on the benefits of forming an LLC versus forming a C-Corp and get right into the purpose of an S-Corp tax designation: saving you money.

LLC or Corporation? You Choose

First, a quick recap. You can designate either a C-Corp or an LLC as an S-Corp. Before you can designate S-Corp status, you must choose your desired entity type.

Selecting your business entity type is one of the most important decisions you’ll make when starting a business. The choice between an LLC and a corporation depends on the goals and needs of the business and its owners. LLCs offer more flexibility in management structure and taxation, while corporations offer more extensive liability protection and a more structured management hierarchy. At ESQx, we can help you pick which type of entity is best for your current situation and future goals.

Management Structure

LLCs are typically managed by their owners, who are called members. Members have the flexibility to manage the company themselves, or they can appoint a manager to handle day-to-day operations. In contrast, corporations have a more structured management hierarchy, with a board of directors overseeing the company’s operations and making major decisions.

Taxation

LLCs are generally taxed as pass-through entities, which means that the profits and losses of the business are passed through to the individual members, who report them on their personal tax returns. Corporations, on the other hand, can be taxed as C corporations, which are subject to corporate income tax, or S corporations, which are also pass-through entities. The choice of taxation depends on the goals of the business and its owners.

Liability Protection

Both LLCs and corporations offer liability protection to their owners, but in slightly different ways. LLCs offer limited liability protection, which means that the personal assets of the members are typically protected from being used to satisfy the LLC’s debts and legal obligations. Corporations, on the other hand, offer more extensive liability protection, which means that the personal assets of the shareholders are typically protected from the debts and legal obligations of the corporation.

What We Do

How Do You Form an S-corporation?

At ESQx, we can help you form an S-Corporation in a few easy steps. For the purpose of this explanation, we’ll rely on the path used to form a C-corp, and at the end we’ll apply the S-corp designation. Ready?

- Obtain an EIN: An Employer Identification Number (EIN) is a unique nine-digit number that the IRS assigns to businesses for tax purposes. You will need an EIN to open a business bank account, pay taxes, and hire employees. In Pennsylvania, it’s advisable to include this in your certificate of organization, so we like to get this step done first.

- Choose a name: Choose a name for your C-Corp that is unique and not already in use by another business in your state. Let it speak to the nature and value proposition of the service or product you are offering. We can help you check the availability of your desired name through the Secretary of State’s office.

- Appoint a registered agent: Appoint a registered agent, who is someone responsible for receiving legal and tax documents on behalf of the C-Corp. The registered agent can be an individual or a company that is authorized to do business in your state. We go into this in more detail in a blog post on the subject.

- File articles of incorporation: Prepare and file articles of incorporation with the Secretary of State’s office. The articles of incorporation include the name of the company, the purpose of the company, the name and address of the registered agent, and the names and addresses of its members.

- Draft bylaws: Corporate bylaws are essential to outlining the ownership and management structure of the corporation, as well as the rights and responsibilities of its shareholders and directors. Corporate formalities are much more intense than LLC requirements, so it’s essential a lawyer help you do this.

- Obtain necessary licenses and permits: Depending on the nature of your business, you may need to obtain certain licenses and permits from state or local agencies before you can begin operating.

- Elect S-Corp status: Once your corporation has been formed, you will need to file IRS Form 2553 to elect S-Corp status for tax purposes. This must be filed within 75 days of the corporation’s formation, or by March 15th of the tax year for which the election is effective, whichever is earlier.

The process of forming an S-corporation can be complex, so get in touch with us today.

What We Do

Here's a Real-Life Example of S-Corps

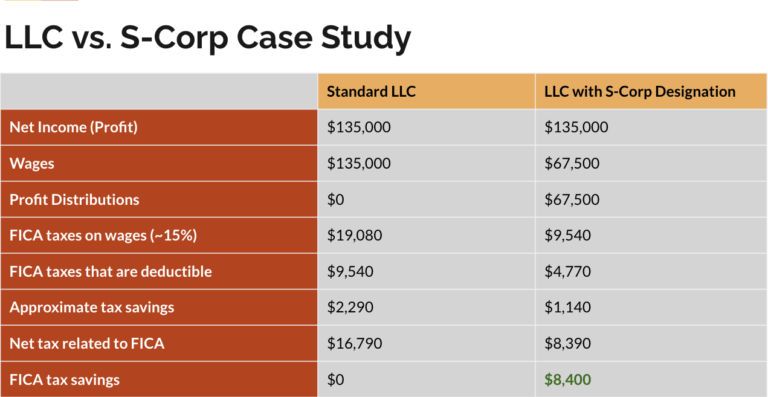

Jerry started an LLC 5 years ago due to its simplicity. His total net income (profit) then (after staff & expenses) was about $35,000. In the following years, demand for his product rapidly grew, and even with similar poundage per season, his net income is now $135,000.

However, his business is still set up as an LLC and the entirety of his $135,000 net income is all subject to FICA Taxes. When his income was lower, FICA taxes on his $35,000 income would have been approximately $5,000. With his current income, FICA taxes on his $135,000 income is now approximately $19,000. He wants to lower his tax burden.

Jerry elects S-Corp status. He must pay himself a reasonable salary, per IRS guidance, which he has determined is half of the total $135,000 net income, or $67,500.

The remaining $67,500 he’s not taking as a salary he takes as dividend distributions, which is not subject to FICA taxes and is passed through to Jerry’s personal tax return as ordinary income.

Once you take into account that half of FICA taxes are deductible (the dollar benefit to you equals the deducted amount multiplied by your ordinary income rate), Jerry could save approximately $8,400 in overall taxes using this strategy.

What We Do

Are There Any Downsides to S-Corps?

Yes, they may end up costing more money in compliance costs over the long run. We have seen some S-Corp tax returns run at least 50-60 pages, which means more work for your accountant. They also do not guarantee a lower tax rate because the amount you pay in tax will depend upon whether you take a distribution.

Let's Talk

Ready to Get Started?

There’s so much more we want to tell you about forming a business if you’ll give us the opportunity! If you’re ready to receive experienced business law formation advice, don’t hesitate to reach out today. We can’t wait to meet you. Did we mention every consultation is free?